How to Evaluate a Solar Lease Proposal for Your Virginia Home

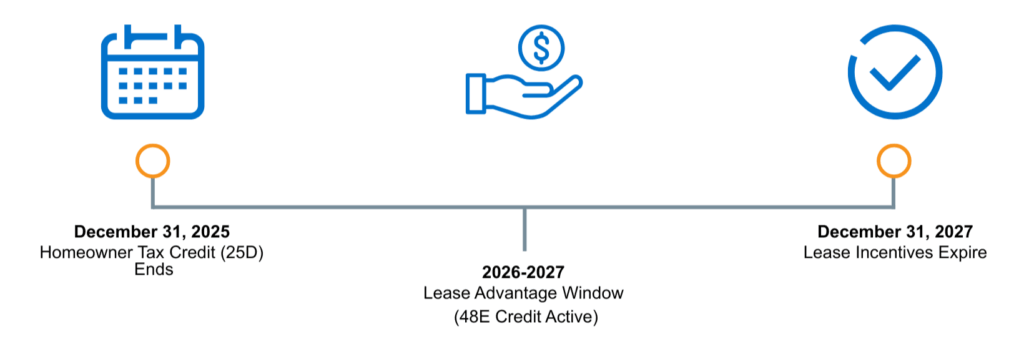

While the federal residential solar tax credit has expired, thousands of Virginians are turning to leasing as a great way to lock in low electricity rates with no upfront costs.

The "New Normal" for Solar in Virginia: Why Leasing Won the Race

If you are reading this article any time after December 2025, you likely know the window to buy solar panels and claim the 30% federal residential solar tax credit (Section 25D) is closed.

But here is the good news: The bill preserved the Section 48E commercial credit, which allows solar leasing companies to claim the tax credit and pass the savings on to you in the form of lower monthly lease payments.

The Catch? This “leasing loophole” also has an expiration date. The TPO (Third-Party Ownership) credit is set to sunset at the end of 2027.

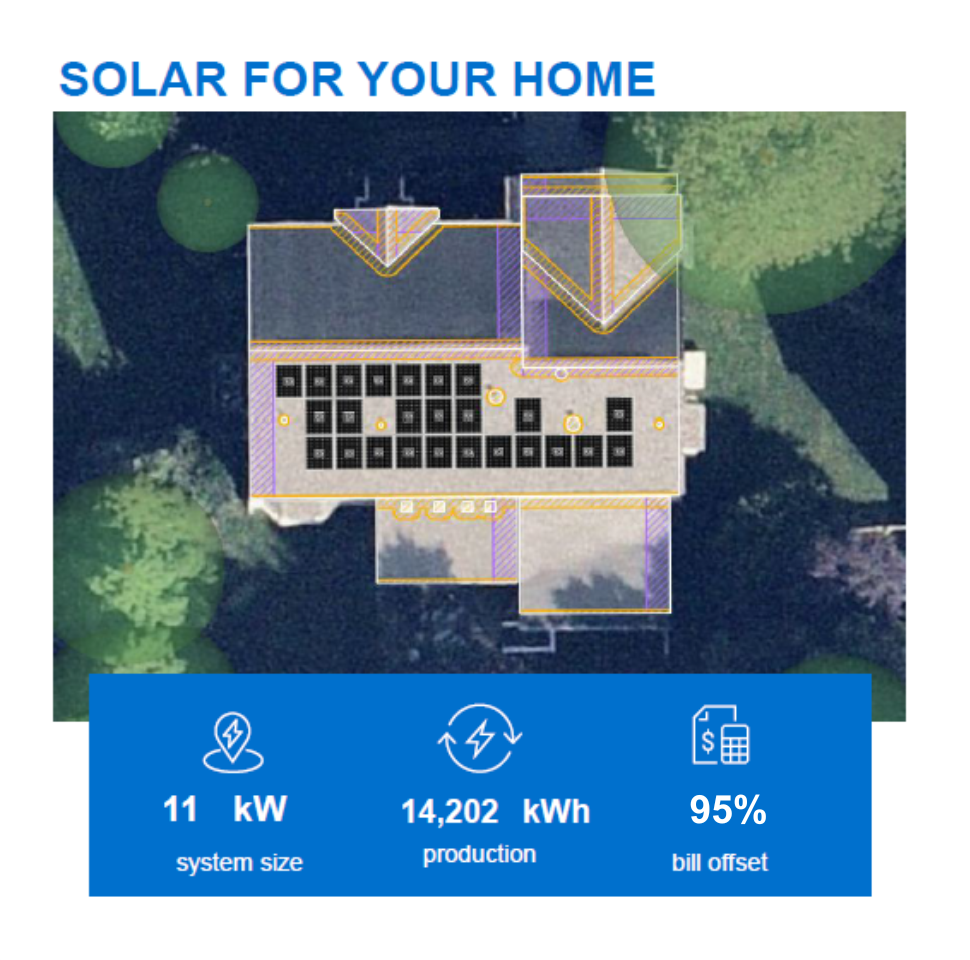

The "Engine" of Your Savings: System Size & Offset

What to look for: Look for the “System Size” (e.g., 11 kW) and “Bill Offset” (e.g., 95%).

How to interpret it:

- Offset: This percentage tells you how much of your current electricity usage the solar system will replace. A 95% offset is excellent—it means the system produces almost all of the power than you typically use.

- Production: The 14,202 kWh figure is your estimated annual production, the estimated production you are paying for.

Dominion Energy Solutions always creates systems that are appropriately sized for your home and energy usage. Read our full Leasing Pros and Cons page to learn more.

The "All-Inclusive" Lease & Warranties

What to look for: “25 Years All-Inclusive Lease” and “10-Year Roof Penetration Warranty.”

The Value to You, the Homeowner:

- Zero Maintenance Risk: In a lease, you do not own the panels. All leases include a 25-year manufacturer’s warranty and workmanship warranty. So, for example, if an inverter fails in year 12, the lessor fixes it, not you.

- Production Guarantee: The proposal includes a “25-Year Production Guarantee.” If the system generates less than 90% of what was estimated, you get reimbursed for the difference. This means the onus to keep the system functioning properly is on the lessor, not you.

- Roof Protection: The 10-year roof penetration warranty is critical. If there’s any roof damage caused by the solar installation, it is covered under the warranty.

Leasing Benefits

Solar leasing let’s you add solar to your home with a 25-year production guarantee, predictable monthly payments, and immediate savings with no upfront costs.

Net Metering: Your Energy Bank Account

Virginia’s Net Metering policy ensures that even with a solar lease, you get full value for every kilowatt-hour (kWh) your system produces.

- 1:1 Retail Credit: If your leased solar panels generate more power than you need, the excess is sent to the utility grid. You receive a credit on your bill for this surplus power at the same rate you pay for electricity.

- Maximum Bill Reduction: You use these banked credits when your system produces less (like at night or overcast days). A system sized for full offset can reduce your utility bill to just the mandatory grid connection fee (around $8).

The Financial Verdict: Leasing Solar Offers Real Savings

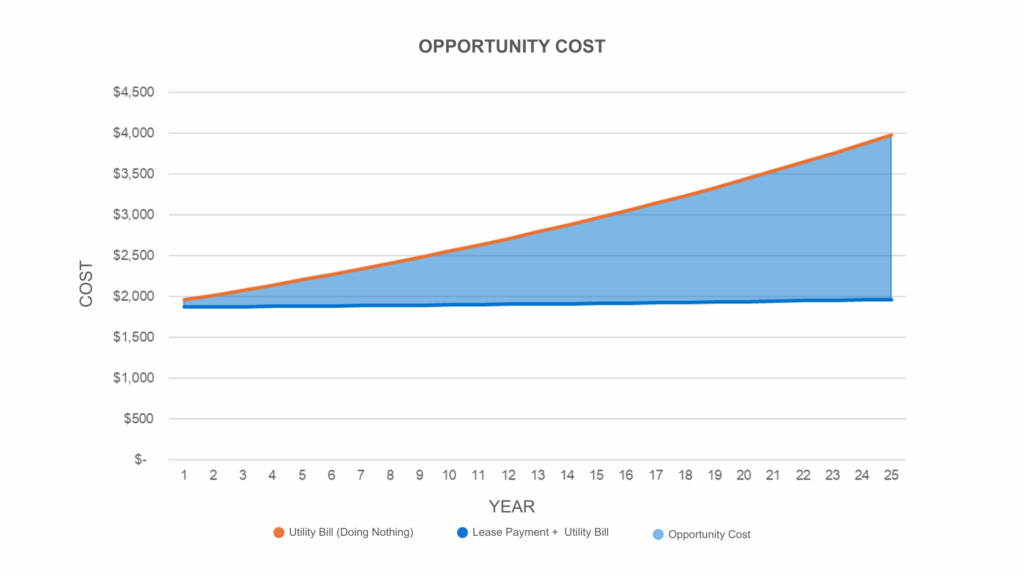

The Opportunity Cost of “Doing Nothing”

Many homeowners ask, “What if I just wait?”

Now that federal residential solar tax credits have expired, most will see two options: lease solar or do nothing. Doing nothing may be the most expensive option for your home. Here’s why:

- Utility Inflation: Utility grid rates have historically risen modestly. While rates here in Virginia are still well below many states in the country, there is an inevitable increase in rates to maintain the grid and the associated costs to provide stable, consistent, available power and common throughout the world, and Virginia is no different. By doing nothing, you are buying your power from the utility at a rate that can increase.

- The 2027 Cliff: If you wait past 2027, the Section 48E tax credit expires. Leasing prices will likely jump significantly because the 30% federal residential solar tax credit will be gone.

- Locked-In Rates: A solar lease locks in your cost for electricity. While your neighbors’ bills fluctuate with global fuel prices and grid demands, your solar lease payment remains predictable, making long-term budgeting easy.